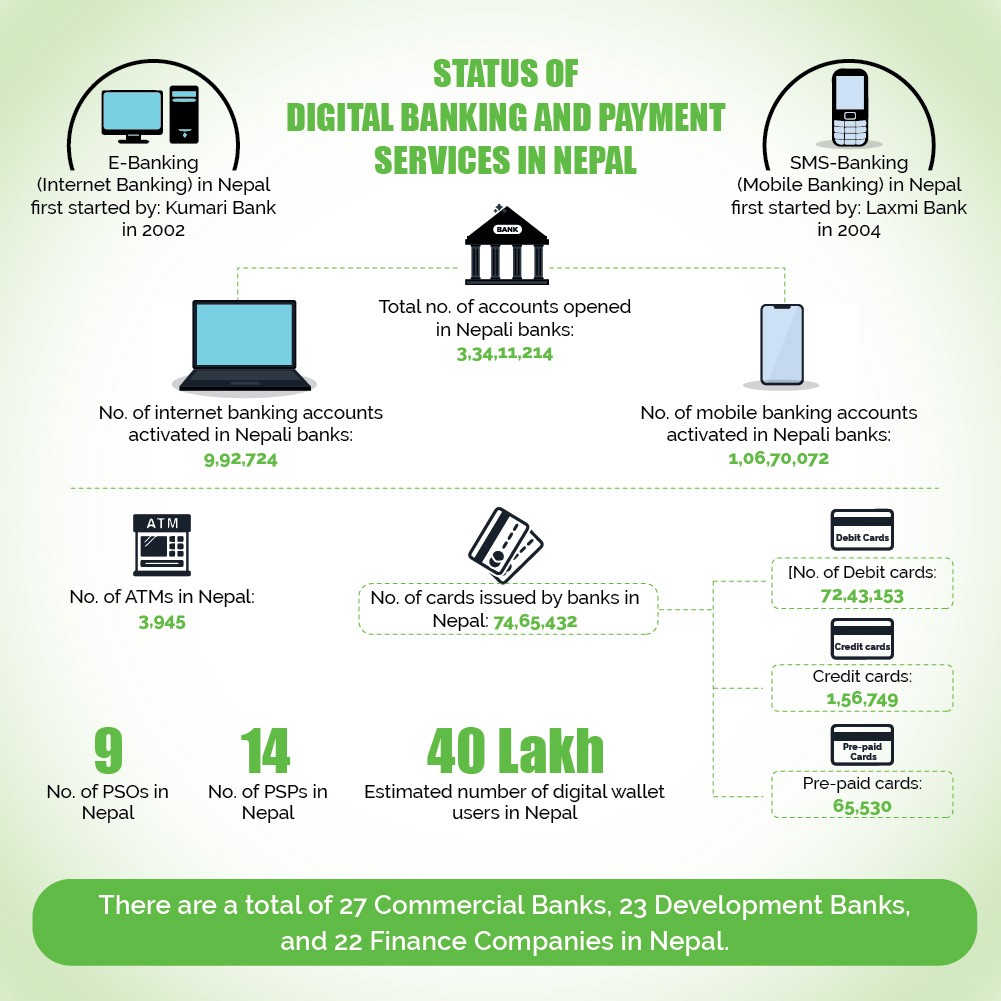

Digital banking is a very recent phenomenon in Nepal. The era of modern banking in Nepal started with Nabil Bank introducing credit cards in the early 1990s. Himalayan Bank introduced ATM and Nepali credit card for the domestic market in 1995. In 2002, Kumari Bank introduced E-Banking (Internet Banking) service for the first time in Nepal. Likewise, in 2004, Laxmi Bank introduced SMS Banking (Mobile Banking) service for the first time in the country.

In the early stage, digital banking services were mainly used to check account statements only. Customers were not much aware regarding the purposes of digital banking and how to use it. It took a long time for digital banking technology to be adopted widely. These days, the adoption of the Internet and smartphone has become common. Customers can now use mobile devices and the Internet to do their banking operation without visiting bank branches. In this article, we will discuss the early phase of digital banking in Nepal, the current trend of digital banking and payment services, and what we might witness in the future. We will also discuss challenges and opportunities of digital banking in Nepal.

Contents

ICT-enabled Banking Delivery Channels in Nepal

Following IT based delivery channels are provided by banks in Nepal:

- E-Banking (Internet Banking)

- Mobile Banking

- Plastic Cards

- Automated Teller Machine (ATM) and Point of Sale (PoS) Machine

- Mobile Wallet (Digital Wallet)

We have explained each of these 5 ICT enabled banking delivery channels below:

Increased Access to Banking Services in Nepal

Nepal has made a commendable progress on expansion of banking access, along with the expansion of digital banking services. As per the latest study report from from Nepal Rastra Bank, “नेपालमा वित्तीय पहुँचको स्थिति: संक्षिप्त अध्ययन”, 60.9% of the population of Nepal has a bank account. It means, only around 39.1% population is unbanked in Nepal.

What has led to the exponential growth of digital banking services in Nepal?

The growth of digital banking services seems to be accelerating in Nepal mainly because of these reasons:

1. Availability of smartphones at cheaper rates

Carrying a smartphone used to be a status symbol in the early 2010s. However, time has changed and cost-effective models of Android smartphones are also available in the market. Currently, smartphone penetration is expected to be over 60% in Nepal.

2. Growth of broadband Internet penetration

As per the latest MIS report from Nepal Telecommunication Authority (Baisakh 2077) broadband Internet penetration has reached 72.22% in Nepal. This has largely been possible because of mobile broadband 3G & 4G services. People from urban areas to remote villages have access to mobile internet now.

3. Anytime, anywhere banking service

A physical branch normally operates from 10AM to 5PM, six days a week. Whereas, with digital banking, you can access banking services 24/7. This too has played a major role in the adoption of digital banking.

4. Cost-effective, faster, and easier banking service

With banking services at our fingertips, we no longer have to visit a physical bank branch to access various banking services. We can activate mobile & Internet banking service at just 250-300 rupees per year and access banking service anytime, and from anywhere.

Furthermore, banks are pushing their customers for digital banking systems since digital banking can serve large customers with relatively lower cost of operation than providing banking service from a physical branch. Digital banking has also increased efficiency of a bank.

In recent times, all banks seem to be focusing on digital banking services. Almost all the banks have released mobile banking apps. Now customers can perform the majority of banking transactions from an smartphone. Digital banking channels have made banking services faster, easier, convenient and more efficient which is driving the growth of the digital banking market in the country.

Growth of digital banking adoption in COVID-19 crisis

In this lockdown period of COVID-19 pandemic, many banks launched the service of opening bank accounts online and filling up e-KYC. Meanwhile, NRB increased the transaction limit bar for digital payments encouraging people to carry out digital transactions. As per an article published in OnlineKhabar, eight lakh mobile banking customers were added in the first three months of lockdown period.

Digital Nepal Framework

From this, we can clearly see Digital Nepal Framework too has encouraged digital banking and payments in the country.

National Payment Gateway

Challenges for growth of digital banking in Nepal

Although there has been competition amongst Banks and Financial Institutions (BFIs) to deliver modern banking services, the majority population in the country has no access to such services. The reason for this is the concentration of BFIs in urban areas. Modern banking services are available in urban areas only, with most people in rural areas being deprived of even the basic banking services.

Banking fees, low literacy levels, and inaccessibility of bank services in rural areas due to poor infrastructure are considered for the low adoption of digital banking services.

Likewise, underdeveloped digital financial services ecosystem with low credit and debit card penetration, low use of digital payments, online and mobile banking, and restrictive government policies (e.g., low maximum limit of digital payments) are thought to be hindering the expected growth and adoption of digital banking and payments services in Nepal.

Opportunities

With Internet penetration rate at 72.22%, Nepal is well positioned to benefit from digital financial services. These solutions (mobile banking, Internet banking, mobile wallets, etc.) have the potential to address challenges such as difficulties accessing banks and the high cost of services.

Development of the digital financial services ecosystem is integral to driving all aspects of the economy. Digital banking can serve the customers who don’t have access to physical branches.

How government can benefit from digital adoption

Digitization offers a lot of opportunities in driving financial inclusion, from improving access to financial services to improving tax collection process. The Government is taking measures toward achieving this, such as digitizing all government transactions to boost the adoption of digital payments. Nepal Government has also started distributing social security allowances and all other government-to-citizen payments through banks to encourage financial inclusion.

The road ahead & future

Through the monetary policy 2077/78, Nepal Rastra Bank has stressed digital banking and electronic payments. Likewise, through the budget of 2077/78, Nepal Government has promised to make the country digital with various initiatives like expansion of digital banking, National Payment Gateway, online tax payment service, implementation of Digital Nepal Framework, etc. People are attracted to banking technology. The current way of adoption of digital banking services is appreciable. Everyone in the ecosystem seems to be working together to develop the digital financial ecosystem in Nepal. Within two decades, the new banking technology has reached almost half of the country’s population. Digital banking is just entering the growth phase in Nepal. The future of digital banking and payment in Nepal seems promising. Digital banking can be a game changer. We are not too far from the day when we will start to see people in remote areas benefiting with digital banking services.

Very detailed and informative article. Expecting to read more of such article in eSewa blog.