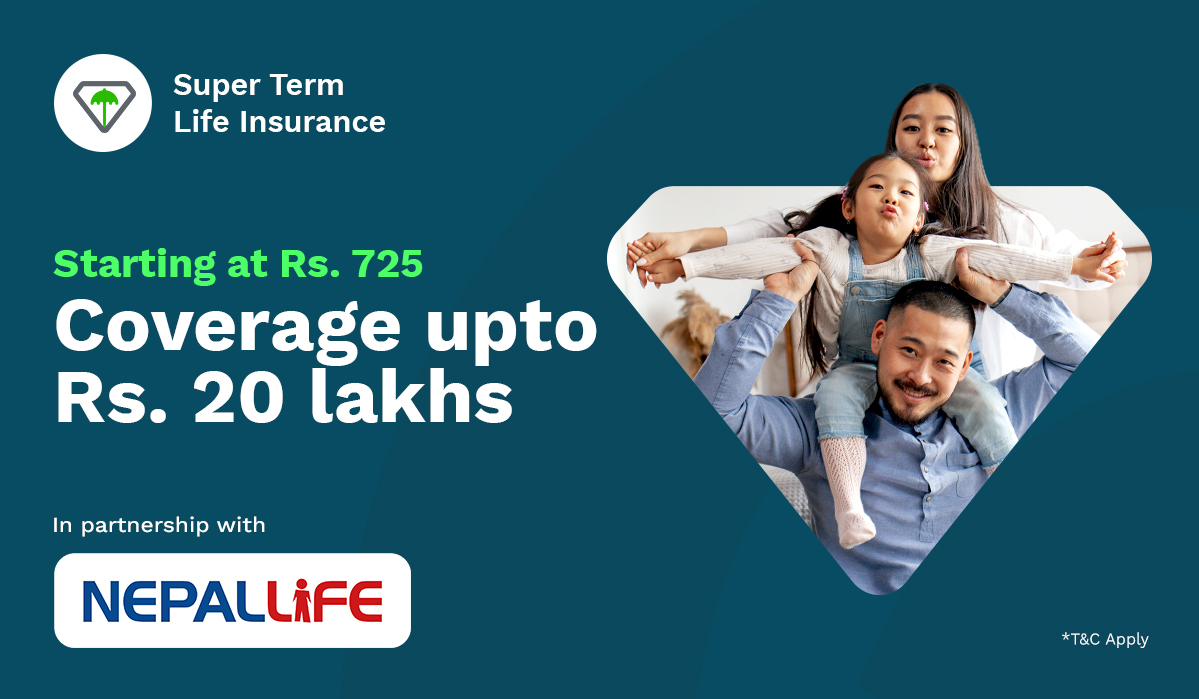

Life can change in a moment, but your family’s financial security shouldn’t have to. To make life protection easier and more accessible for everyone, eSewa has introduced Super Term Life Insurance, a brand-new insurance plan in partnership with Nepal Life Insurance.

This plan provides essential financial protection by covering both natural and accidental death, ensuring your loved ones are supported in difficult times. And the best part? It starts at just Rs. 725.

What is Super Term Life Insurance?

Super Term Life Insurance is a simple and affordable 1-year term life plan designed to offer financial security for your family. If the insured person passes away due to natural or accidental causes during the policy period, the selected coverage amount is paid to their beneficiaries.

With flexible coverage options ranging from Rs. 5,00,000 to Rs. 20,00,000, you can choose protection that suits both your needs and your budget without compromising on security.

Key Features

- Starting Premium: Rs. 725

- Coverage Options:

- Rs. 5,00,000

- Rs. 10,00,000

- Rs. 15,00,000

- Rs. 20,00,000 - Policy Period: 1 Year

- Eligible Age Group: 18 to 60 Years

- Insurance Partner: Nepal Life Insurance

Why choose Super Term Life Insurance?

- Protects your family financially in the event of natural or accidental death

- Easy to purchase online through the eSewa app

- Affordable premium with flexible coverage amounts

- No paperwork or long-term commitment

Terms and Conditions

- Eligibility: Available for individuals aged 18-60.

- Coverage: 1-year policy, covering both natural and accidental death.

- Claims: Must be submitted within 30 days of the incident.

- Premium: Starting at Rs.725 per year and varies by age and coverage amount.

- Information: Users must provide correct and complete information.

Documents required for the claim process

- Copy of the insured’s death certificate

- Copy of the insured’s citizenship certificate

- Copy of the claimant’s citizenship certificate

- Copy of proof of relationship between the insured and the claimant

- Claim form

- Letter from the policyholder regarding the insurance claim

- Autopsy report / Post-mortem report (in case of accidental or suspicious death)

- Police report (in case of accidental or suspicious death, if applicable)

- Incident site report (in case of accidental or suspicious death)

- Hospital discharge report (if death occurred in a hospital)

- Any other documents required by the company depending on the nature of the incident or as required for investigation

Buy Super Term Life Insurance easily through eSewa app and enjoy peace of mind knowing that your loved ones are financially protected.

Don’t have eSewa app? Download Now!

Click here for IOS Click Here for Android